Reckoning with Growth

Daniel Susskind’s new book, Growth: A Reckoning (2024), opens with an important question about a remarkable fact: why did the real incomes of ordinary people in the United Kingdom rise so rapidly from the mid-1700s on, after many millennia of effective stagnation?

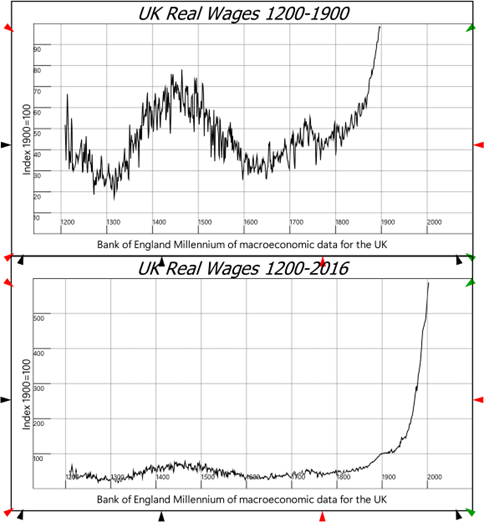

People struggling with the cost-of-living crisis today might not believe this is true, but Susskind illustrates this fact with data from the Bank of England’s excellent Millenium of Macroeconomic Data project. Using historical records on basic consumption items, the Bank of England indexed real wages to 100 in 1900, and showed that, though wages fluctuated over time, between 1200 and the late 1800s, the real wage never exceeded 80% of its 1900 level. Then, with a take-off that can be dated back to the mid-1700s, real wages rose dramatically, to six times the 1900 level by the year 2000, as Figure 1 illustrates.

Susskind observes that, though there had been 600 years of dramatic change before 1750, these changes did not increase the standard of living of the ordinary citizen of England:

Six centuries rich in revolutionary moments—the arrival of the printing press in the fifteenth century and the attendant explosion in literacy, the English Reformation in the sixteenth century and a violent religious schism, the Glorious Revolution in the seventeenth century and a new conception of the state—yet economic life was essentially unchanged. According to Figure 1, an Englishman’s living standard, measured by his real wages, was no better in 1809 than back in 1209.

(p. 4)

Why did this remarkable change occur? The obvious answer is the Industrial Revolution. But, Susskind asks, why did the Industrial Revolution have this impact, why did it occur when it did (the 1750s), and why did it occur where it did (in Scotland). Channelling Douglas Adams’s The Hitchhiker’s Guide to the Galaxy (1979), Susskind asked “What is the Answer to the Great Question about Growth, Prosperity, and Everything?”

I hope that fans of Hitchhiker’s will forgive me for saying that Susskind’s answer to this ultimate economic question is almost as disappointing as the giant computer Deep Thought’s declaration that “The Answer to the Great Question of Life, the Universe and Everything” was “Forty-two.” Susskind’s answer for what enabled growth to take off in the 1750s, in Scotland, is “ideas.”

The Hitchhiker’s Guide to the Galaxy tells us that Deep Thought arrived at its disappointing answer after seven and a half million years of intense computation. Susskind reached his by channeling about a century’s worth of economic theory.

To the obvious riposte that people had plenty of ideas before the Industrial Revolution—little things like Newton’s Laws of Motion, for example—Susskind says that a change in culture in the 1700s meant that a different form of ideas came to the fore:

“there was a change in collective focus: people were no longer content to understand the world for the sake of intellectual satisfaction or to make abstruse philosophical observations, as in the Scientific Revolution or the Enlightenment, but wanted to use it in the real world ‘to improve mankind’s condition’”… Scotland developed “a ‘scientific culture’ that committed people to use reason in pursuit of real-world problems (like, for example, how to increase output in a factory).”

(p. 51. The quotes within this quote come from one of Susskind’s’ three key references, Joel Mokyr’s A culture of growth : the origins of the modern economy (Mokyr 2016))

So, it wasn’t just “ideas,” but a different approach to ideas… We were no longer contemplating the nature of “Life, the Universe, and Everything,” but getting down to brass tacks about how to make more stuff in factories, in order to make people happier.

The explanation that growth came from ideas was first developed by the second of Susskind’s key references, Nobel Prize winner Robert Solow 1950’s paper “A Contribution to the Theory of Economic Growth” (1956). When Solow measured the causes of growth, he concluded 87.5% of it was due to better ideas, and only 12.5% to other factors. Susskind’s third key reference, by another Economics Nobel Prize winner, Paul Romer, explains why more ideas enable more productivity, whereas more machines do not. This is because ideas are “non-rivalrous”: two people can use the same idea at once, whereas two people cannot use the same machine at once.

That’s the gist of the book. Economic growth took off in the 1750s because of “ideas.” The reason that ideas made a difference then, but hadn’t earlier, is because culture shifted from focusing on “abstruse philosophical observations” to ideas that would “‘improve mankind’s condition.’” This boiled down to “how to increase output in a factory.”

That’s it? I’d be hard pressed to say which of “ideas” and “42” is a less inspiring answer to a monumentally important question.

In Adams’s brilliant work of fantasy, the solution to the inadequate answer about Life, the Universe, and Everything, was to build another computer—the planet Earth itself—to work out what the actual question really was. Fortunately, finding a significant answer to the Ultimate Question about Growth, the Economy is not so difficult; rather than building a new planet, it requires taking the one we’re living on more seriously. This was in fact done by a famous 19th century economist named William Stanley Jevons.

Today, Jevons is known as one of the founders of Neoclassical economics—the approach to economics which dominates the discipline today, and of which Susskind is a typical modern example. When Jevons considered the same question that Susskind tackled, his answer was not something as intangible as “ideas,” but a very tangible substance: coal.

The reason growth commenced in the 1750s Scotland, Jevons asserted, was because that was when industry began to exploit the enormous energy contained in coal. Ideas matter, necessarily: but they were ideas about coal. And the reason that these ideas occurred in Scotland rather than elsewhere was that Scotland had lots of coal.

Indeed, coal was in the title of Jevons’s book The Coal Question. First published in 1865, it opened with the statement that:

DAY by day it becomes more evident that the Coal we happily possess in excellent quality and abundance is the mainspring of modern material civilization. As the source of fire, it is the source at once of mechanical motion and of chemical change. Accordingly, it is the chief agent in almost every improvement or discovery in the arts which the present age brings forth. [emphasis added]

Jevons thus credited not ideas in general, but energy, and coal in particular, for the growth ignited by the Industrial Revolution. Ideas were of course critical to harnessing this energy—ideas like Watt’s idea of a separate condenser to dramatically improve the efficiency of Newcomen’s steam engine. But what clearly distinguished the ideas of the Industrial Revolution from the ideas of the Scientific Revolution was not the culture in which they occurred—though culture does matter—but the energy they enabled Scotland to harness from coal. And these intangible ideas did not matter until they were turned into very tangible machines embodying them, such as Newcomen’s steam engine in 1712, and Watt’s dramatically more efficient engine in 1776.

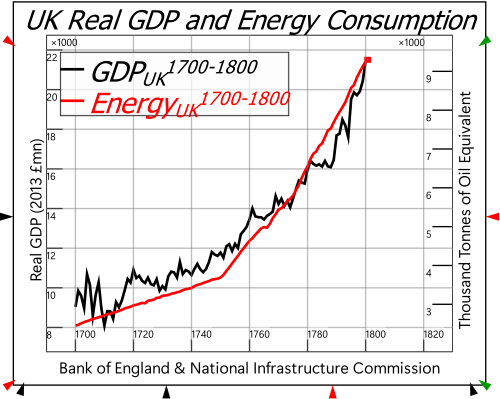

The statistics strongly support Jevons’ perspective that energy—and specifically energy from coal—caused rising living standards in the UK (see Figure 2). Very tangible coal, and not an intangible hypothesized change in culture, propelled the rise in living standards that Susskind attributes to “ideas.”

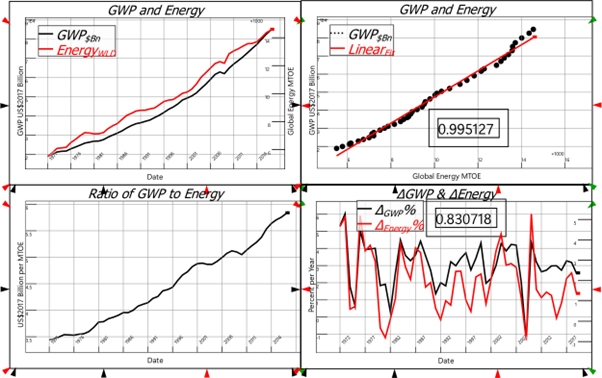

That trend continues today, with energy at the global level. Gross World Product (GWP) and energy are even more tightly coupled than GDP and energy were in the UK during the Industrial Revolution: GWP has risen because energy consumption has risen. The correlation between GWP and Energy is 0.995, and while this high figure is in part because both GWP and Energy are generally increasing, the correlation of change in energy to change in GWP is still a staggering 0.83—see Figure 3. To a first approximation, GWP is energy, converted from the raw forms which we find in Nature, into forms that are useful for human consumption.

Susskind appears to be unaware of this alternative explanation of growth. While “coal” was literally the second word in Jevons’s book (after the word “the” in the title), it appears only twice in Growth: A Reckoning, and both times as a criticism of the degrowth movement, rather than as an explanation of why growth occurred in the first place.

In fact, most of the remarkable things in Susskind’s book are the things that are barely there at all. You would expect a book on growth, published in April 2024, to devote considerable attention to one of the obvious side-effects of fossil-fuel-based growth: global warming. But the phrase doesn’t appear at all, and the word “warming” appears only once. “Fossil fuels” themselves make a brief appearance on page 100, then disappear for 135 pages, after which they return a few times between 100 and 80 pages from the book’s end. The word “energy” first appears, as something other than the title of a body or person, almost 60% of the way through the book, and then not as a possible explanation of the phenomenon the book purports to both explain and champion—economic growth—but in another criticism of the degrowth movement.

These puzzling absences are not Susskind’s fault, but the fault of the Neoclassical school of economics to which he belongs. Though Jevons was a key founder of the Neoclassical approach, he wrote before economists had developed what they call “production functions”, which purport to explain where output—and therefore the growth in output—come from. Jevons acknowledged the critical role of energy in production, but his successors did not.

The very first production function was developed by the economist Paul Douglas and mathematician Charles Cobb in 1928, and it described output as the result of combining Labour and Capital (machinery), but it omitted both energy and raw materials. Though Cobb and Douglas did speculate about including them—”Finally, we should ultimately look forward toward including the third factor of natural resources in our equations”—this was never done, and Neoclassical economists became accustomed to using a production function—known as the “Cobb Douglas Production Function”—in which inputs from the natural world played no part. As my coauthors and I pointed out in “A Note on the Role of Energy in Production,” this is a critical error, because nothing can be produced without energy. As we put it: “labour without energy is a corpse, while capital without energy is a sculpture.”

When this fundamental fact is introduced mathematically into the Cobb Douglas Production Function, it shows that what economists call “Total Factor Productivity”—and which Susskind describes simply as “ideas”—is in fact the energy consumed by the typical machines of a given age, and transformed into useful work by those machines.

Of course, ideas are necessary to create the machines that harness that energy, but without that energy, those machines—from Watt’s original steam engine in 1776 to Musk’s Falcon Nine rockets today—would just be inanimate sculptures.

Economic growth therefore requires a growing use of energy. This is what makes continuing growth on our finite planet impossible, which Susskind quite literally denies when he states that “it is possible to have infinite growth on a finite planet” (Susskind’s emphasis). His logic is an extreme version of the argument that a move towards a service-based economy will “decouple” GDP from physical inputs:

the idea of a ‘finite planet’ is rooted in an old-fashioned view of economic activity. It pictures the economy as a material world, a place where tangible stuff is combined to produce more tangible stuff … it’s true that in a solely material world there are obvious physical limits on economic activity: only so many acres of land that can be farmed, only so much raw material for production. But contemporary service-based economic life is far more weightless than the old world of farms and factories.

If only this were true, then human civilization would not be in peril from global warming. But it isn’t true, as the bottom left-hand plot in Figure 3 illustrates. Though the ratio of GDP to energy has risen, from 3.5 billion 2017 US dollars per Million Tonnes of Oil (MTOE) in the 1970s to 6 billion today, this is a slow, linear increase, which is nowhere near fast enough to justify the fantasy of a “far more weightless … service-based economic life” in the near future.

Susskind asserts otherwise via a chart from Our World in Data (OWD), which shows rising GDP and falling emissions from 25 countries. But these were countries which OWD had selected specifically because they have had growing GDP and falling emissions. In our globalized economy, the aggregate picture is what matters, and as Figure 3 shows, at the global level, energy and GDP are tightly coupled. With 85% of our energy still coming from fossil fuels, further growth will cause further global warming, when we are now perilously close to triggering critical tipping points in the Earth’s climate. Susskind’s confidence that we can continue growing indefinitely on this finite planet is simply not credible.

This would not matter if Susskind were an economic maverick, but in fact he expresses the opinion of the majority of mainstream economists that growth can go on forever, and that global warming is not a serious problem. William Nordhaus, who was awarded the Nobel Prize for his work on the economics of climate change, also showed that he was unaware of the role of energy in production when he commented that:

for the bulk of the economy—manufacturing, mining, utilities, finance, trade, and most service industries—it is difficult to find major direct impacts of the projected climate changes over the next 50 to 75 years.

Similarly, the economics chapter of the 2014 IPCC report ignored the role of energy in production when it stated in its Executive Summary that:

For most economic sectors, the impact of climate change will be small relative to the impacts of other drivers (medium evidence, high agreement). Changes in population, age, income, technology, relative prices, lifestyle, regulation, governance, and many other aspects of socioeconomic development will have an impact on the supply and demand of economic goods and services that is large relative to the impact of climate change.

These sanguine assertions by Neoclassical economists are wildly at variance with reality, in large measure because they ignore the role of energy in production. But, because politicians and journalists don’t know how they reached these assertions, they have taken them seriously. This, as much as special pleading by fossil fuel companies, has resulted in humanity’s to date trivial efforts to curtail greenhouse gas emissions.

This is a serious policy mistake—and probably the worst policy mistake in the history of humanity. A reckoning is indeed coming from growth, and very soon. But it is not the reckoning that Susskind—or mainstream economists in general—are expecting.

Susskind did ask an important question. Unfortunately, his book shows that economists are the last people on Earth who are capable of answering it.

Bibliography

Adams, Douglas. 2003. The Hitchhiker’s Guide to the Galaxy: The Original Radio Scripts. additional material by M. J. Simpson. (25th Anniversary ed.) (Pan Books: London).

Cobb, Charles W., and Paul H. Douglas. 1928. ‘A Theory of Production’, The American Economic Review, 18: 139-65.

IPCC, D.J. Arent, R. S. J. Tol, E. Faust, J.P. Hella, S. Kumar, K.M. Strzepek, F.L. Tóth, and D. Yan. 2014. ‘Key economic sectors and services.’ in C.B. Field, V.R. Barros, D.J. Dokken, K.J. Mach, M.D. Mastrandrea, T.E. Bilir, M. Chatterjee, K.L. Ebi, Y.O. Estrada, R.C. Genova, B. Girma, E.S. Kissel, A.N. Levy, S. MacCracken, P.R. Mastrandrea and L.L. White (eds.), Climate Change 2014: Impacts, Adaptation, and Vulnerability. Part A: Global and Sectoral Aspects. Contribution of Working Group II to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change (Cambridge University Press: Cambridge, United Kingdom).

Jevons, William Stanley. 1866. The Coal Question; An Inquiry concerning the Progress of the Nation, and the Probable Exhaustion of our Coal-mines (Macmillan and Co.: London).

Keen, Steve, Robert U. Ayres, and Russell Standish. 2019. ‘A Note on the Role of Energy in Production’, Ecological Economics, 157: 40-46.

Lenton, Timothy, David I. Armstrong McKay, Sina Loriani, Jesse F. Abrams, Steven J. Lade, Jonathan F. Donges, Manjana Milkoreit, Tom Powell, S.R. Smith, Caroline Zimm, J.E. Buxton, Emma Bailey, L. Laybourn, A. Ghadiali, and J.G. Dyke. 2023. “The Global Tipping Points Report 2023 ” In. Exeter, UK.: University of Exeter.

Mokyr, Joel. 2016. A culture of growth : the origins of the modern economy / Joel Mokyr (Princeton University Press: Princeton).

Nordhaus, William D. 1991. ‘To Slow or Not to Slow: The Economics of The Greenhouse Effect’, The Economic Journal, 101: 920-37.

Romer, Paul M. 1990. ‘Endogenous Technological Change’, Journal of Political Economy, 98: S71-S102.

Solow, R. M. 1957. ‘Technical change and the aggregate production function’, Review of Economics and Statistics, 39: 312-20.

Solow, Robert M. 1956. ‘A Contribution to the Theory of Economic Growth’, The Quarterly Journal of Economics, 70: 65-94.

Susskind, Daniel. 2024. Growth: A Reckoning (Penguin: London).